Specialized services and expertise are available to help businesses, owners, families, and individuals maximize their finances, minimize taxes and risks, and strategically plan for their future. We provide help through a comprehensive service offering that reflects professionalism, technical efficiency, and human sensitivity. The result is knowing that our business finances services provide a trusted advisor that looks out for all of your needs.

All or our clients receive personal attention and senior management guidance that they expect working with smaller firms, backed by the resources and service offerings of a leader. We are recognized as a top CPA firm in the United States, and offer a full range

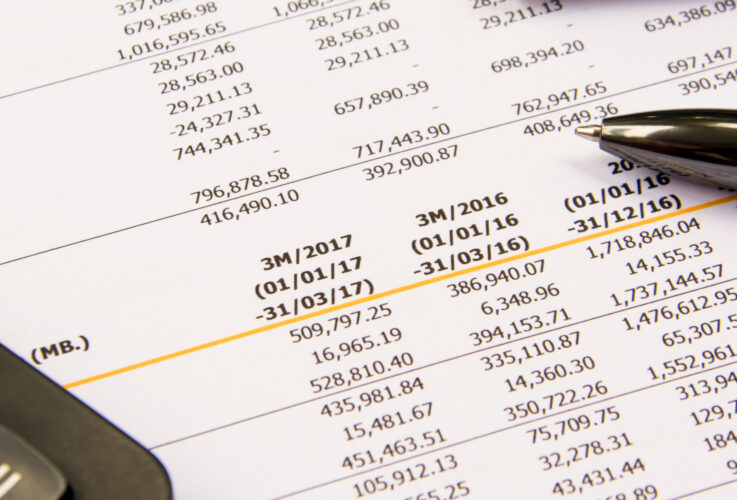

Some of our financial statement preparation services include:

• Audits of Financial Statements

• Reviews & Compilations of Financial Statements

• Corporate Individual Tax Preparation & Planning

• Financial & Compliance Audits

• Attestation Engagements

• Internal Controls Assessments

• Uniform Guidance audits

• Agreed upon Procedures